Artificial intelligence is shifting from analysis to action. Mode is building the next layer of autonomous execution.

Autonomous Execution

In the coming decade, we won’t just use AI to process information, we’ll use it to decide when to act, how much to risk and what to ignore.

This transition is already visible in trading. Markets generate endless signals, but the real edge lies in identifying which ones matter and executing them without hesitation. The combination of AI-driven signal detection and autonomous execution is transforming how modern systems trade.

At Mode, we’ve been building the foundations for this future - where traders define intent and intelligent agents handle execution. Our aim isn’t to replace human judgment, but to give it a faster, more consistent form.

From Signals to Execution

Every trader knows that good ideas are rarely the problem. The difficulty lies in applying them the same way, every time, under pressure.You can recognise a breakout but hesitate to act. You can see a trend forming but exit too soon. In fast markets, hesitation is costly. In volatile ones, emotion is fatal.

Mode AI Trading Agents were built to close that gap. Using AI to identify and respond to market structure in real time, then execute trades with mechanical precision.

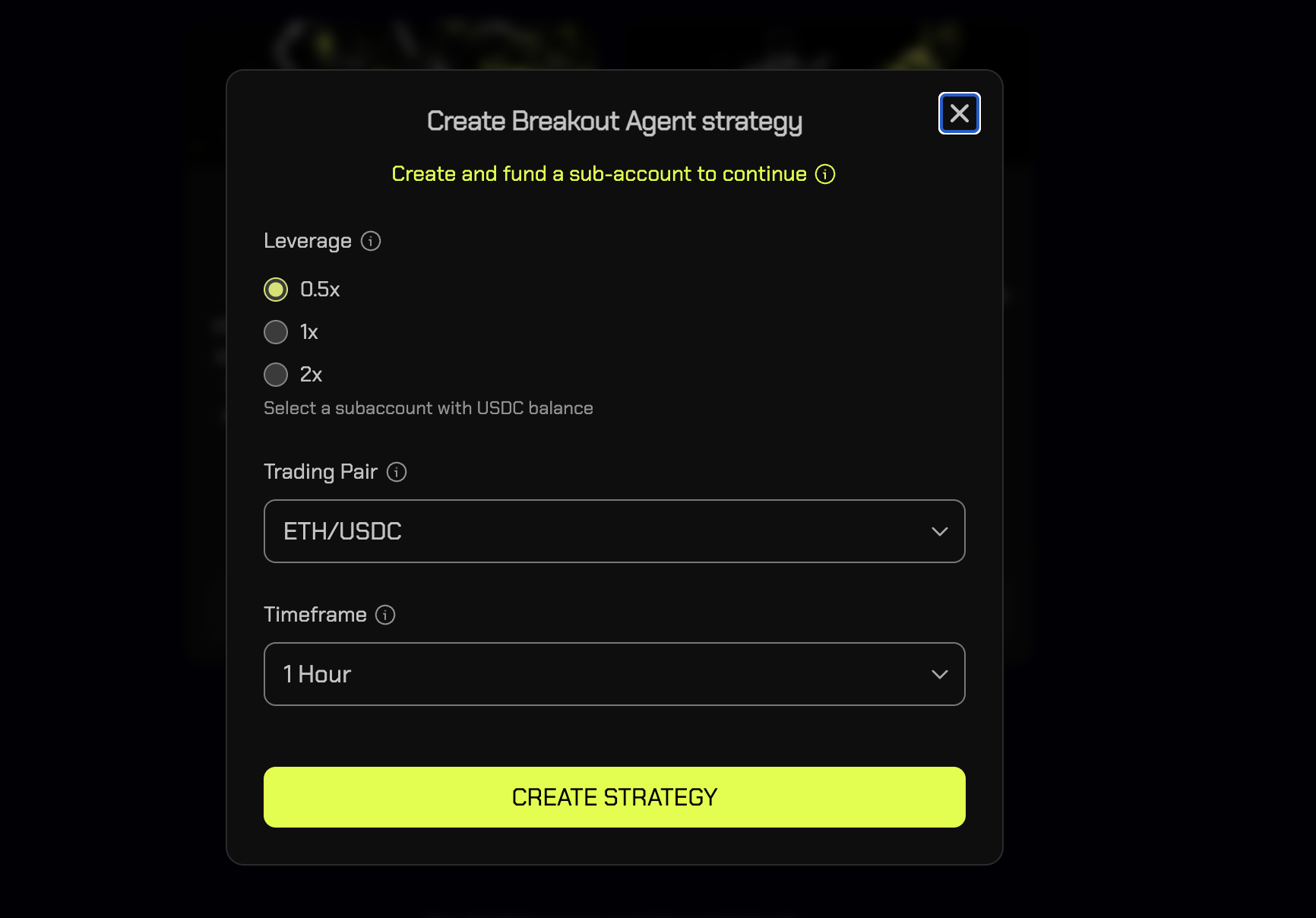

Each AI Trading Agent lives inside its own Mode sub-account. It observes the same price data you do but without fatigue, distraction or bias. It scans continuously for signals generated by Mode’s proprietary AI models; systems trained to recognise momentum shifting into breakouts and the formation of trends across timeframes.

This blend of AI signal detection and rule-based risk management allows agents to operate as autonomous traders; consistent, explainable and aligned with your intent.

The First Generation

We’re starting with two core archetypes that reflect some of the most universal behaviours in markets:

-

Breakout Agent - trained to detect volatility and expansion, positioning as prices break from consolidation zones and closing quickly after momentum drops.

-

Trend Agent - designed to participate in slow persistent moves once trend strength exceeds statistical thresholds and gets out once it’s sure the trend’s over.

Both AI Trading Agents trade under controlled limits, whilst taking care not to overfit them, as not to fall short in live trading. If there’s a breakout, it’ll catch it. If there’s a trend, you’ll be in it until it ends.

For step by step instructions on how to launch your own Agents check out our AI Trading Agents Quickstart Guide **HERE **

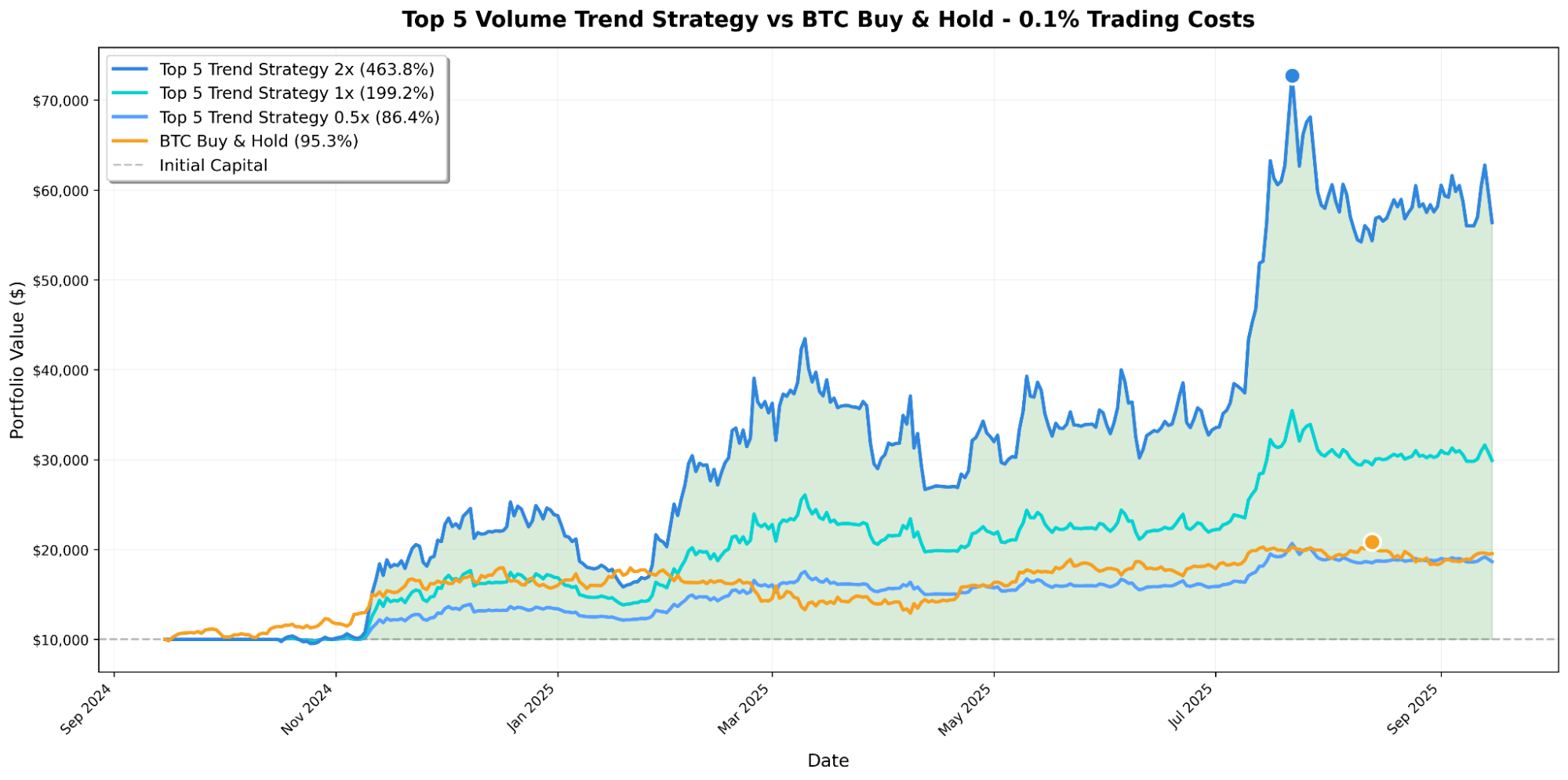

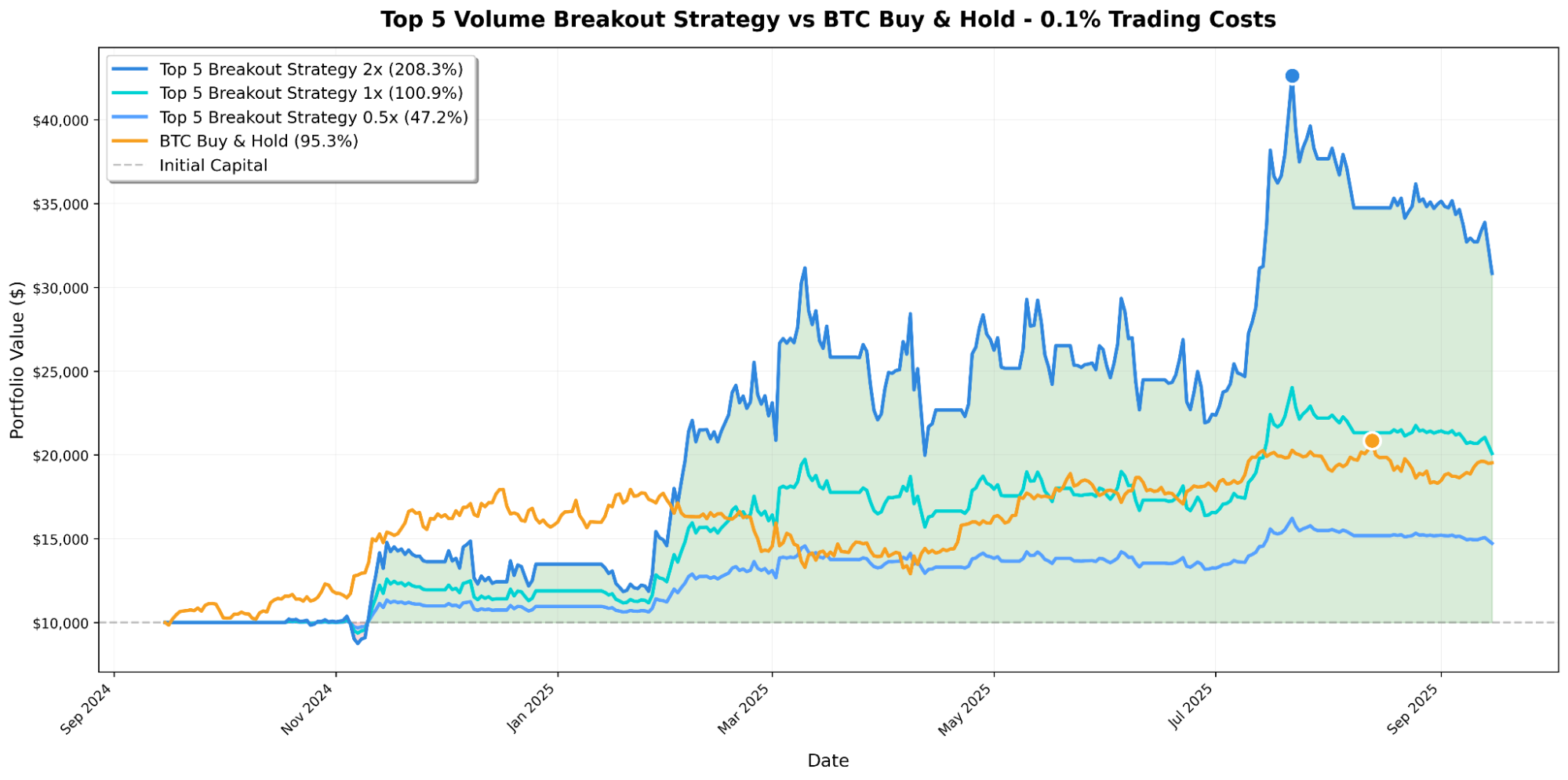

Performance vs. Buy and Hold

To evaluate performance, we compared these agents against the most neutral benchmark available: a simple buy-and-hold position.

Buy and hold represents continuous exposure, a strategy that performs best when volatility trends upward but can leave you in deep, long drawdowns. Its risk profile is linear: the same exposure, through all conditions.

Our agents operate differently. They allocate capital conditionally, entering markets when volatility structure supports an edge and withdrawing when conditions deteriorate.This conditional participation produces a different kind of equity curve, one that looks less dramatic but far more stable.

When tested across BTC, ETH, and top volume coins both the Breakout and Trend Agents demonstrated lower drawdowns and a smoother equity path compared with buy and hold. In bull phases, they captured substantial upside; in sideways regimes, they often sat flat avoiding the grind of directionless volatility.

The backtests below show the performance of our Trend Agent and Breakout Agent applied to the five highest-volume trading pairs during each entry period, capital divided among positions using 0.5×, 1×, and 2× leverage with 0.1% trading costs. This approach highlights how allowing gains to compound can meaningfully affect long-term performance. The results illustrate how higher leverage amplifies returns and drawdowns, while diversified, volume-based selection improves capital efficiency across market cycles. Whilst there were two large outliers in July, it goes to show what can be achieved by bringing your intent to pair selection.

Getting the most out of Mode AI Trading Agents

Automation only reaches its potential when used deliberately. The best results come not from betting big, but from deploying many small, independent systems each trained to specialise, each contributing its own edge. Here’s how to get the most from your agents:

-

Trade a broad universe Deploy agents across multiple markets, majors and liquid altcoins alike. Strategies perform best when they can diversify signal detection. Broader coverage means more opportunities for structured participation without increasing risk.

-

Maintain independence Each agent operates in a separate sub-account, executing without interference. That independence makes it possible to measure real performance comparing behaviour across assets and strategies without cross-contamination.

-

Focus on distributions, not single trades The strength of AI-driven execution lies in repetition. You’re not aiming to predict each outcome but to shape the statistical distribution of many. Over time, consistency compounds in ways intuition never can.

-

Let the agents run manual overrides - closing trades early or changing size mid-run destroy the integrity of the process. Treat agents like instruments, not experiments. Give them time to show their edge. When approached this way, Mode Trade Agents become a way to observe markets through behaviour, not belief.

What’s Next

This launch marks the foundation of a broader ecosystem, one that combines human insight, AI signal generation and verifiable execution.

In the coming months we’ll:

-

Onboard leading traders and researchers to design more specialised AI Trading Agents built on our infrastructure; agents that blend human intuition with algorithmic precision.

-

Collaborate with Traders and professional strategists to share their trading logic in transparent, measurable ways, allowing users to deploy trusted systems through Mode.

-

Move toward verifiability using open standards like ERC-8004, ensuring that every agent’s logic and performance can be audited, proven and attributed on-chain.

The long-term vision is clear:

A network of autonomous, verifiable agents that trade on behalf of human intent, combining the interpretive power of AI with the transparency of open systems.

Final Thoughts

The future of trading isn’t about eliminating risk; it’s about understanding it. AI will never make markets completely predictable but it can make your participation more adaptive, consistent and potentially pick up on things you can’t.

Mode AI Trading Agents are our contribution to that future: intelligent systems that use AI to detect structure, manage volatility and execute your intent with precision. In a world where attention is scarce and reaction times are measured in milliseconds, consistency is the real edge.

About Mode

Mode is an Ethereum L2 and perpetuals dex scaling DeFi through AI agents and AI-driven financial applications.

Website: mode.network

AI Trading Agents: Agents

Mode Trade: Trade

Mode Terminal: AI Quant

Community TG Groups: Telegram groups