Week From 2025-03-03 To 2025-03-10

Bitcoin Price Action

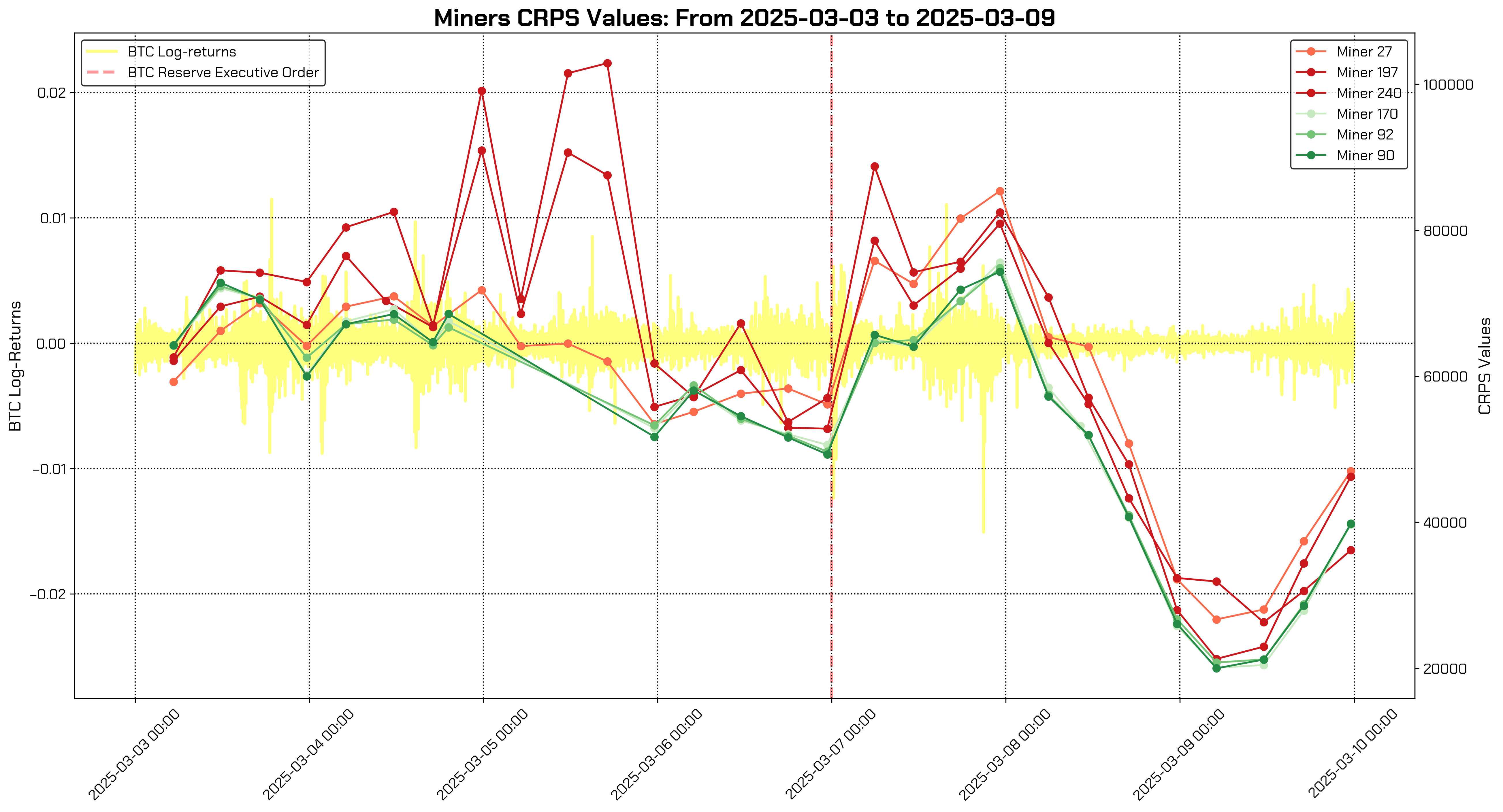

During the week of March 3rd to March 10th, Bitcoin experienced significant volatility, with fluctuations in volatility regimes and an overall downward trend. The price started the week at approximately $94,300 and ended at around $80,700, marking both the weekly high and low.

These price movements were largely driven by macroeconomic and geopolitical uncertainties, affecting not only the cryptocurrency market but also traditional financial markets. The most notable volatility spike occurred around midnight (UTC) on March 7th, coinciding with the U.S. president's executive order on the BTC strategic reserve.

Miners Performance

For this analysis, we examined the performance of six miners: the top three according to leaderboard scores at the beginning of the period (midnight, March 3rd) and the top three at the end of the period (11:59 PM, March 9th). The selected miners were:

-

Best miners at midnight on March 3rd: Miners 27, 197, and 240.

-

Best miners at 11:59 PM on March 9th: Miners 90, 92, and 170.

This commentary provides an overview of these miners' performance throughout the week, particularly in relation to the volatility trends discussed earlier. Our analysis focuses on key metrics such as the Continuous Ranked Probability Score (CRPS), Softmax scores, and Leaderboard values. Miners who were top performers at the beginning of the period are represented in shades of red, while those who emerged as top performers at the end are shown in shades of green. Scores were recorded at four equidistant time points per day.

Continuous Ranked Probability Score (CRPS)

Softmax scores provide a clearer comparison by applying a transformation to the CRPS values relative to all miners. Using a new β coefficient of -0.002, we amplified small differences in CRPS scores.

As a result, Miners 90, 92, and 170 consistently outperformed their peers in most prompts throughout the week. Miners 170, 90, and 92 exhibited the most stability in achieving high scores, except during the second prompt on Monday, March 3rd, and the second prompt on Thursday, March 6th, where Miner 27 outperformed the others. Notably, all analyzed miners performed poorly on Sunday, March 9th, with scores close to zero.

Softmax Scores

Softmax scores offer a clearer view of how miners performed relative to one another, as they consist of a softmax transformation of the CRPS values of the single miners vs. all the other miners. Using the new β coefficient equal to -0.002 for the calculation of the scores contributes to magnifying relatively small differences in CRP scores between miners. Unlike CRPS values, higher Softmax scores denote better performance.

Because of what just outlined, we can observe how Miners 90, 92, and 170 consistently received higher scores than other miners for almost all of the week’s prompts. Miners 170, 90, and 92, on the other hand, seemed to have a bit more consistency in getting the best scores (with the exception of the second observed prompt on Monday 3rd and the second prompt of Thursday 6th, where Miner 27 was assigned higher scores), most of the time as a “lagged effect” of significant volatility spikes. On the last day of the week, that is, Sunday 9th, all miners under analysis performed poorly, receiving scores very close to 0.

Leaderboard Scores

Consistent with the CRPS and Softmax trends, Miners 27, 197, and 240 experienced a significant decline in their leaderboard scores, dropping from above 0.03 at the start of the week to near zero by the end. In contrast, Miners 90, 92, and 170 showed the opposite trend, benefiting from the evolving volatility dynamics.

Takeaways

The past few weeks have been marked by substantial volatility spikes and a persistent downtrend in Bitcoin, signaling weak market sentiment. This environment has exposed certain flaws in the current Synth subnet scoring system. Specifically, miners who incorporate drift in their forecasts or make extreme predictions have, at times, achieved high CRPS scores purely by chance rather than skill.

Due to the Softmax scores being capped at zero on the lower end, some miners have been incentivized to take outsized risks, treating the prediction system like a lottery. To address this, the Synth team is developing a revised scoring framework designed to penalize extreme predictions more effectively. This updated system will leverage CRPS values for calculating smoothed moving average scores, delaying the Softmax transformation to a subsequent step.

As the team finalizes tuning and backtesting this new system, miners are encouraged to refine their forecasting models, focusing on accuracy and robustness rather than relying on sporadic high-risk predictions.

About Mode

Mode is building Full Stack DeFAI, the L2 scaling DeFi to billions of users through AI agents and AI-driven financial applications. Bolstered by a $6 million grant from Optimism, Mode continues to push for an open, efficient, and inclusive financial future on the Superchain.

Website: mode.network

Forum: forum.mode.network

Community TG Groups: Join our Telegram groups